To post a new support question, click the Post New Topic button below.

Current Version: 4.9.2 | Sytist Manual | Common Issues | Feature Requests

Please log in or Create an account to post or reply to topics.

You will still receive notifications of replies to topics you are part of even if you do not subscribe to new topic emails.

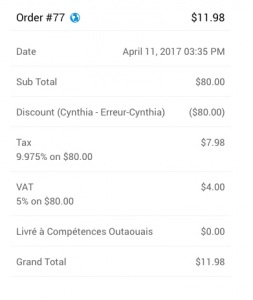

Coupon Code Applied Before Taxes And Client Had To Pay For The Taxes

M

Marie-Therese Lesieur

15 posts

Tue Apr 11, 17 2:45 PM CST

Tim - PicturesPro.com

16,247 posts

(admin)

Wed Apr 12, 17 5:59 AM CST

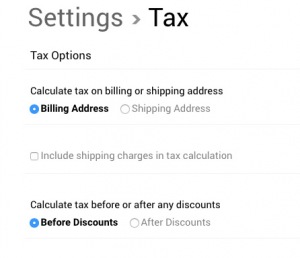

Go to Settings -> Tax.

"Calculate tax before or after any discounts" ... what is that set to?

"Calculate tax before or after any discounts" ... what is that set to?

Tim Grissett, DIA - PicturesPro.com

My Email Address: info@picturespro.com

My Email Address: info@picturespro.com

Tim - PicturesPro.com

16,247 posts

(admin)

Fri Apr 14, 17 8:01 AM CST

You should set it to after if you want the tax calculated after the discount.

Tim Grissett, DIA - PicturesPro.com

My Email Address: info@picturespro.com

My Email Address: info@picturespro.com

K

Kathryn Yannalfo

16 posts

Fri Apr 21, 17 9:42 AM CST

Hi Tim,

I need the coupon to calculate tax before applying but apply the coupon after the tax. Example - I create my $30 coupon with a range of $26 - $30 - client purchases $28, the tax is calculated correctly making the total $29.93 but then the coupon is only coming off product total of $28 leaving the client having to pay the $1.93 tax. Any way to get the coupon to come off the total after tax and shipping?

Kat

I need the coupon to calculate tax before applying but apply the coupon after the tax. Example - I create my $30 coupon with a range of $26 - $30 - client purchases $28, the tax is calculated correctly making the total $29.93 but then the coupon is only coming off product total of $28 leaving the client having to pay the $1.93 tax. Any way to get the coupon to come off the total after tax and shipping?

Kat

Tim - PicturesPro.com

16,247 posts

(admin)

Sat Apr 22, 17 7:26 AM CST

You should set it to calculate tax after the discounts if you want it to cover all of it. I don't see a reason to calculate tax before, but have the coupon cover the entire order and so no tax is actually being paid.

Or sounds like you might want to actually assign an account credit and have the credit come off like a payment (view the person's account in the admin to do that).

Or sounds like you might want to actually assign an account credit and have the credit come off like a payment (view the person's account in the admin to do that).

Tim Grissett, DIA - PicturesPro.com

My Email Address: info@picturespro.com

My Email Address: info@picturespro.com

K

Kathryn Yannalfo

16 posts

Sat Apr 22, 17 7:55 AM CST

You have to calculate tax on the whole purchase. Example above the client prepays $30 but decides to only purchase $28 in product - tax is calculated on the $28 and this brings it to 29.93 still within the deposit amount (they forfeit the .07) so the tax calculation works because I have set to calculate tax before coupon but the coupon is applied before the tax (and shipping) is totaled, so the client is only getting $28 in coupon credit and not the $29.93. Account credit helps but I sell the coupons to up to 500plus clients a dance season so it is only when they notify me prior to placing the order that the system wants to charge them tax that I can switch the credit from coupon to account credit. Otherwise I have to do refunds (yuck). Make sense?

Tim - PicturesPro.com

16,247 posts

(admin)

Mon Apr 24, 17 4:02 AM CST

There just isn't an option to have the coupon pay for tax at this time. I will make a note to look into it.

Tim Grissett, DIA - PicturesPro.com

My Email Address: info@picturespro.com

My Email Address: info@picturespro.com

K

Kathryn Yannalfo

16 posts

Mon Apr 24, 17 5:28 AM CST

Thanks Tim!

K

Kathryn Yannalfo

16 posts

Fri Jun 02, 17 11:23 AM CST

HI Tim,

Just checking if you have anytime to think on this?

Thanks as always for such great products!

Kat

Just checking if you have anytime to think on this?

Thanks as always for such great products!

Kat

Tim - PicturesPro.com

16,247 posts

(admin)

Mon Jun 05, 17 5:21 AM CST

It is still on the to-do list to look into.

Tim Grissett, DIA - PicturesPro.com

My Email Address: info@picturespro.com

My Email Address: info@picturespro.com

This reply was deleted.

Please log in or Create an account to post or reply to topics.

Loading more pages